What Is The Kelly Criterion?

The Kelly Criterion is a mathematical formula that helps bettors determine the optimal size of a bet to maximize their long-term profits. It was developed by John L. Kelly Jr. in the 1950s while working at Bell Labs. The criterion considers the edge (the difference between the expected return and the actual odds) and the size of the bettor’s bankroll.

The Origin and Development

The Kelly Criterion was initially created for communication system design. Later, it gained prominence in the world of gambling and investing when its utility for managing uncertainty became apparent. It has since become a foundational principle in both fields.

Why It Matters in Betting

The Kelly Criterion is of paramount importance in betting due to its potential to deliver long-term profits while minimizing the risk of going broke. It forms the cornerstone of disciplined bankroll management and is widely adopted by professional bettors who prioritize both profit and capital preservation.

The Mathematics Behind The Kelly Criterion

The Kelly Criterion relies on fundamental principles of probability and expected value. A bet is deemed valuable when the expected return is greater than the amount wagered. Understanding these principles is essential for making the most of the criterion.

The Core Equation

The core equation of the Kelly Criterion is a straightforward but powerful formula: f* = (bp – q) / b.

Kelly Criterion f= (bp – q) / b

Where:

-

f: represents the fraction of the bankroll to bet

- b: The decimal odds offered by the bookmaker (excluding the stake)

-

p: The probability of winning the bet

-

q: The probability of losing the bet (1 – p)

The resulting value represents the proportion of one’s bankroll that should be wagered on the bet. For instance, a Kelly Criterion value of 0.05 suggests that 5% of the bankroll should be allocated for that particular bet.

Interpreting the Output

The output of the Kelly Criterion is a fraction, which signifies the proportion of your bankroll to wager. A positive output suggests a value bet, while a negative output advises against betting. Interpreting the output correctly is essential for effective bankroll management.

How To Build A Predictive Betting Model

Applying The Kelly Criterion in Sports Betting

The first step in applying the Kelly Criterion is to calculate the edge, which is the difference between your estimated probability of success and the implied probability in the odds provided by the bookmaker. The larger the edge, the more you should consider wagering.

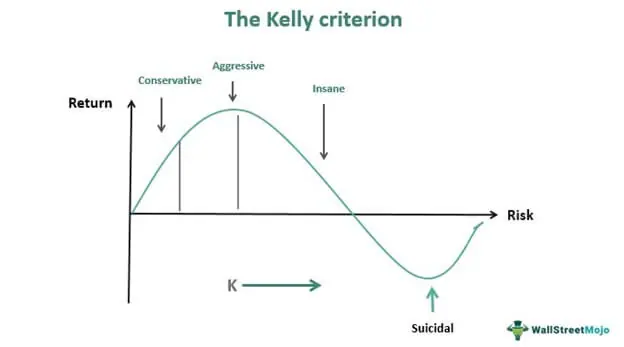

The Kelly Criterion rarely advises betting your entire bankroll. It usually suggests a fraction of your bankroll. This fraction is the optimal bet size, ensuring that you can grow your bankroll while limiting the risk of ruin.

There are common pitfalls in using the Kelly Criterion, such as overestimating your edge or dealing with varying bankrolls. Adjustments are sometimes necessary to account for practical factors and fluctuations in your betting capital.

Benefits and Risks of The Kelly Criterion

Advantages of Kelly Criterion: The primary advantages of the Kelly Criterion are capital growth and risk management. It allows bettors to make the most of their edge while protecting their bankroll from excessive losses.

Managing Downswings and Variance: The Kelly Criterion also plays a crucial role in managing downswings and the inherent variance in sports betting. It helps bettors to withstand losing streaks while still benefiting from winning streaks.

The Impact of Over-betting: One of the risks associated with the Kelly Criterion is the potential for over-betting, which can lead to significant volatility in your bankroll. A disciplined approach and fractional Kelly betting can mitigate this risk.

Strategies for Success with The Kelly Criterion

Embracing Discipline: Discipline is key when using the Kelly Criterion. Stick to your calculated bet sizes and avoid emotional reactions to losses or wins. Consistency is the path to long-term profitability.

Adapting to Evolving Bankrolls: As your bankroll grows or shrinks, adjust your bet sizes accordingly. Regularly recalculate your optimal bet fraction to ensure it aligns with your current situation.

Staying Informed and Updated: Successful application of the Kelly Criterion in sports betting demands staying informed about the latest odds, injury reports, team news, and other factors that can influence the probability of success.

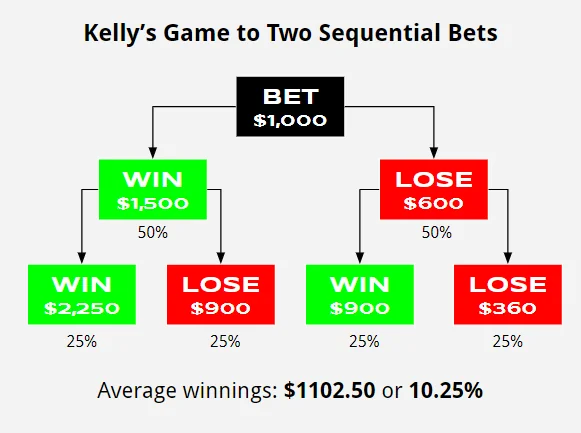

Real-world Examples

To illustrate the practical application of the Kelly Criterion, we delve into specific sports bets and demonstrate how the formula can be used to calculate optimal bet sizes.

To demonstrate the practical application of the Kelly Criterion, let’s dive into a detailed example of how you can use this strategy for specific sports bets.

Imagine you’re interested in placing a bet on a football match, and you’ve done your research. You believe that Team A has a 60% chance of winning, and the bookmaker offers odds of 2.00 for Team A’s victory. Here’s how you can apply the Kelly Criterion to determine the optimal bet size:

- Calculate the edge: The edge is the difference between your estimated probability (60%) and the implied probability from the odds (1/2.00 = 50%). So, your edge is 10% (60% – 50%).

- Plug the numbers into the Kelly Criterion formula:f* = (bp – q) / b

- f*: Optimal bet fraction

- b: Odds received (2.00)

- p: Estimated probability (60% or 0.60)

- q: Probability of losing (100% – p or 40% or 0.40)

- Calculate f*:f* = (2.00 * 0.60 – 0.40) / 2.00 f* = (1.20 – 0.40) / 2.00 f* = 0.80 / 2.00 f* = 0.40

The Kelly Criterion suggests that you should bet 40% of your bankroll on Team A. If your initial bankroll is $1,000, this means you should wager $400 on this bet.

By following this approach, you are maximizing your potential long-term profits while minimizing the risk of significant losses. Keep in mind that this method ensures that you gradually increase your bankroll over time, making it a powerful tool for disciplined sports bettors.

Case Studies of Successful Bettors

This section features real-life case studies of successful bettors who have leveraged the Kelly Criterion to achieve consistent profits in sports betting.

Case studies of successful bettors who have leveraged the Kelly Criterion highlight the real-world applicability of this strategy.

Case Study 1: The Professional Sports Handicapper

John is a professional sports handicapper with a long history of successful betting. He applies the Kelly Criterion to his bets, and over several years, he’s achieved consistent profits.

John’s success can be attributed to his discipline in following the recommended bet fractions. He never lets emotions drive his wagering decisions. By maintaining a diversified portfolio of bets across different sports, he manages risk effectively.

Case Study 2: The Mathematical Mind

Sarah, an avid sports fan with a strong background in mathematics, decided to apply the Kelly Criterion to her sports betting. She started with a modest bankroll and carefully calculated her optimal bet sizes.

Over the course of a year, Sarah documented her bets and meticulously followed the Kelly Criterion’s recommended bet fractions. Although she experienced both winning and losing streaks, her bankroll steadily grew. The formula allowed her to take advantage of her edge while limiting the impact of inevitable losses.

Case Study 3: The Long-term Investor

James approached sports betting with a long-term investment mindset. He recognized the power of the Kelly Criterion in optimizing bankroll growth. To minimize risk, James only bet a fraction of his bankroll, as recommended by the formula.

Over the years, James witnessed the value of discipline and bankroll management. He didn’t let the short-term volatility discourage him. As a result, he enjoyed steady profits and preserved his capital effectively.

These case studies exemplify how the Kelly Criterion, when diligently applied, can lead to success in sports betting. The key takeaways include disciplined bankroll management, a commitment to following the formula’s recommendations, and a focus on long-term profitability. By incorporating this strategy into their betting approaches, these successful bettors have navigated the challenges of sports betting with precision and consistency.

Conclusion: A Tool, Not a Guarantee

The Kelly Criterion serves as a valuable tool for understanding the mathematical principles of optimal bet sizing. However, it’s essential to recognize its limitations and apply it judiciously within a broader betting strategy

Maximize your bets today with our Free Kelly Criterion Calculator!!!